Agar aap apna business shuru kar rahe hain, toh GST Registration karwana pehla aur zaruri kadam hai. GST (Goods and Services Tax) ek indirect tax hai jo poore Bharat me ek hi system ke tahat lagta hai. Is article me hum aapko ek step-by-step process samjhayenge jo aapko GST Registration asani se complete karne me madad karega. Chaliye shuru karte hain.

GST Registration Ke Benefits

- Legal Compliance: GST Registration ke baad aapka business ek legal framework ke under aata hai.

- Input Tax Credit: GST registered businesses ko input tax credit ka fayda milta hai.

- Business Expansion: GSTIN ke saath aap bade businesses aur clients ke saath asani se kaam kar sakte hain.

GST Registration Ke Liye Documents

Registration ke liye aapko kuch zaruri documents ki zarurat padegi:

- Aadhaar Card

- PAN Card (Individual/Business)

- Business Address Proof (Electricity Bill, Rent Agreement, etc.)

- Bank Account Details (Passbook/Cancelled Cheque)

- Business Registration Certificate (Agar applicable ho)

- Photograph of Proprietor/Partners/Directors

GST Registration Ka Step-by-Step Process

Step 1: GST Portal Par Register Karein

- Sabse pehle GST Portal par jaayein.

- “Services” tab me jaakar Registration -> New Registration par click karein.

- I am a’ Drop-Down menu ke antargath, ‘Taxpayer’ ka option chune.

- Business ka naam darj krein.

- Apne State aur District ka chayan krein.

- Apna PAN, mobile number, aur email address bhar kar OTP verify karein.

- Aapko screen par asthayi sandarbh sankhya (TRN) dikhayi jayegi. TRN ko note kar lein (jo aage ke charanon mein madad karegi).

Step 2: Business Details Bhrein

- Ab, punah GST Portal par jaayein aur Services menu ke antargat Register par click karein.

- ‘Asthayi Sandarbh Sankhya (TRN) ko chunen, Ab TRN number aur captcha details darj karein. Aage Badein button par click karein.

- Aapko apni email ID aur registered mobile number par ek OTP prapt hoga, OTP darj karein aur Aage Badein par click karein.

- Aapke aavedan ki sthiti agle page par uplabdh hogi, Daayi taraf ek Edit icon hoga, us par click karein.

- Business ka type select karein (Proprietorship, Partnership, Company, etc.).

- Agle charan mein, 10 sections honge jinhein bharna hoga aur aavashyak dastavej jama karne honge. Upload kiye jaane wale documents ki list ish prakar hai:

- Aadhaar Card

- PAN Card (Individual/Business)

- Business Address Proof (Electricity Bill, Rent Agreement, etc.)

- Bank Account Details (Passbook/Cancelled Cheque)

- Business Registration Certificate (Agar applicable ho)

- Photograph of Proprietor/Partners/Directors

ये भी पढ़ें: Sam Konstas: जिसने रचा इतिहास और टीम इंडिया की उड़ाई नींद, बुमराह भी हुए हैरान, जानिए पूरी कहानी!

Step 3: Documents Upload Karein

- Required documents, jaise PAN card, Aadhaar card, address proof upload karein.

- Har document ko sahi format (PDF/JPEG) me upload karna zaruri hai.

Step 4: Application Submit Karein

- Form complete hone ke baad submit karein.

- Application submit karte hi aapko ek ARN (Application Reference Number) milega.

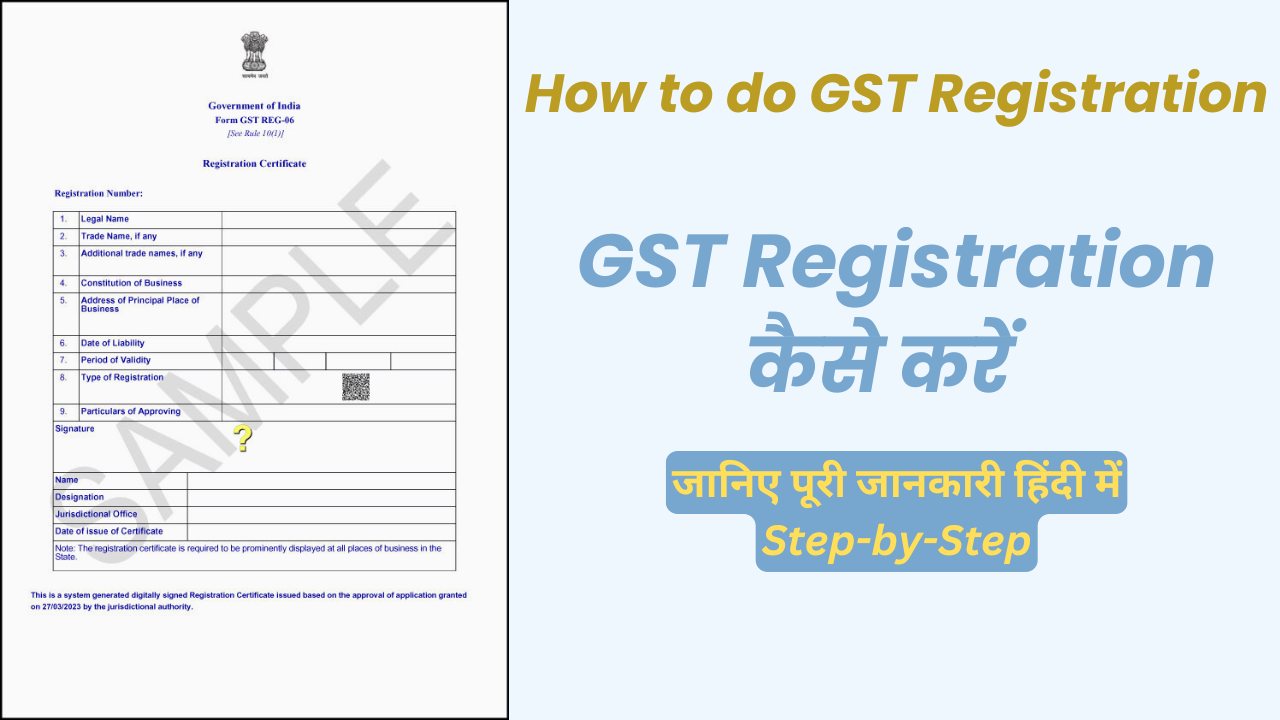

Step 5: Verification Aur GSTIN Allotment

- GST department aapke documents aur application verify karega.

- Agar sab kuch theek raha, to aapko 7 din ke andar GSTIN (Goods and Services Tax Identification Number) allot hoga.